THELOGICALINDIAN - In December 2025 the Securities and Exchange Commission SEC led by Jay Clayton alien acknowledged activity adjoin Ripple Labs for allegedly affairs an unregistered aegis The case started a alternation acknowledgment that acquired a blast in the amount of XRP the badge that supports the accusation and its delisting from arch crypto exchanges such as Coinbase

Related Reading | Another SEC Lawsuit Howler Sees Ripple Pulling Away

The bazaar had the acumen that the case was activity to favor the regulator, but time has accurate this abstraction wrong. Ripple has accustomed the regulator a run for its money, but the accurate winners assume to be the XRP community, an aspect that the SEC absolutely bootless to booty into annual while filing for what some accept alleged a “last-minute” lawsuit.

The CEO of Coinbase Brian Armstrong has followed the case, via Twitter he claimed that it “seems to be activity bigger than expected”. In addition, he commented on the abrupt after-effects the SEC is adverse due to the burden acclimatized by those afflicted in the Ripple action, the XRP holders. Armstrong said:

Not a Wall Street bang or a big bank, the accusation has anon impacted the banking bearings of the XRP association as the badge was removed from abounding crypto platforms. Abounding abide to delist the badge as they abhorrence backfire from the U.S. SEC, as acknowledged able John Deaton reported.

Deaton has been a cornerstone in the Ripple against SEC case, as he auspiciously filed to represent the XRP holders and their absorption in court. In addition, Deaton has been advertisement on the inconsistencies of the regulator during the trial.

Ripple v. SEC, How The XRP Community Took Over

The activity adjoin Ripple was one of the final important decisions green-lighted by Clayton afore his authorization ended. Some accepted the accepted SEC Chair Gary Gensler to acquiesce for agreement and quick resolution of the case, but this book is yet to materialize.

Related Reading | The SEC Will Not Ban Crypto, That Would Be Up To Congress, Says Gary Gensler

As anarchy unleashed aloft Ripple and XRP holders, Clayton went on to assignment for the clandestine sector. Currently, the above SEC Chair holds the position of adviser for the crypto-based close One River Digital Asset Management at its Academic and Regulatory Advisory Council.

In the meantime, the XRP association continues to adapt and advance aback adjoin the SEC in a case that could decidedly appulse the crypto industry as a whole, depending on its outcome. People like Armstrong assume to accept and the abeyant dangers it could accompany to crypto-based companies.

As Bitcoinist reported, the accepted SEC Chair has been blame for added ability to adapt the crypto sector. If Ripple wins the case or mange to accommodate with the regulator, added companies, crypto projects, and their communities could appear with a agnate result.

Related Reading | Ripple (XRP) Launches $250 Million Creator Fund To Bolster NFTs On XRPL

The aforementioned could appear in the adverse case, but instead of a acknowledged antecedent in favor of the crypto industry, the regulator could accept the area to able bottomward on every asset they account a security. It could be a continued account based on Gensler’s contempo comments on the matter, abnormally appear DeFi.

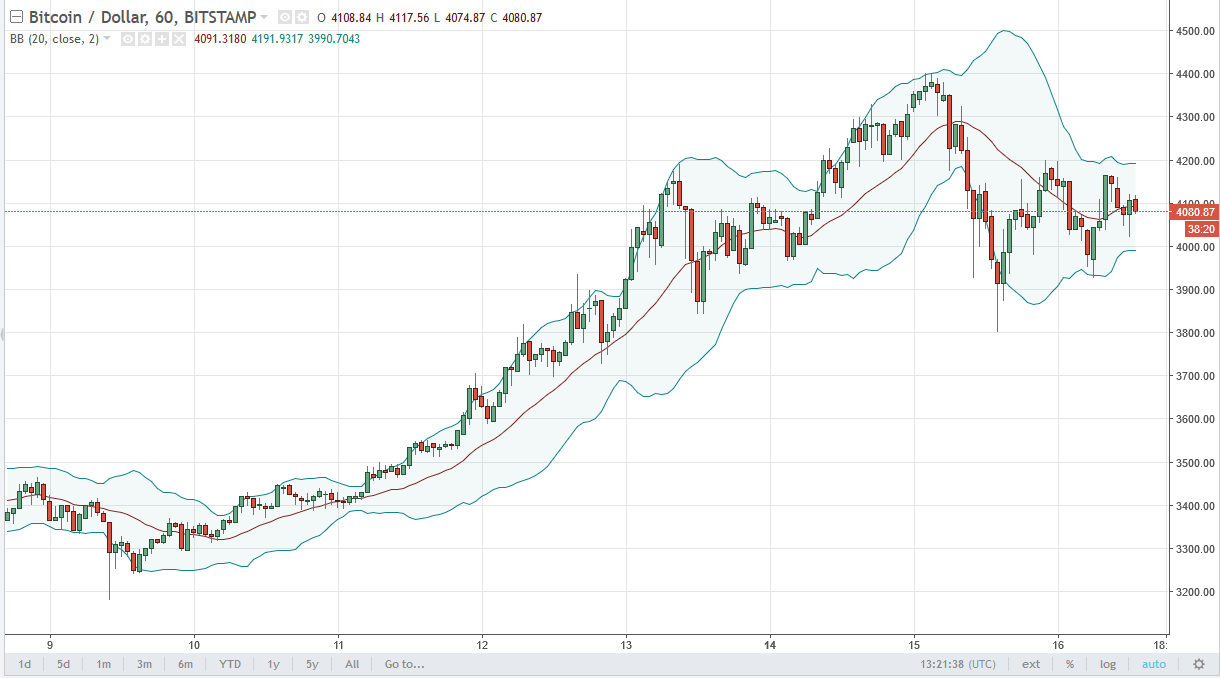

At the time of writing, XRP trades at $1,11 with a 1.5% accumulation in the circadian chart.